capital gains tax changes canada

He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate. Currently depending on your tax bracket a capital gain is taxed at a rate that is as much as 14 to 20 less than a dividend.

Capital Gains Tax In Canada Explained Youtube

Typically you pay a higher tax rate on short-term capital holdings versus long-term ones.

. Under the rules currently in force only until the end of 2016 when Eligible Capital Property is sold for a gain as a part of a discrete transaction or a complete sale of a business as a going concern fifty percent 50 of the gain is taxable as. A capital gains tax increase would be a form of annual wealth tax that would be. Youve got just under two weeks left to file your taxes.

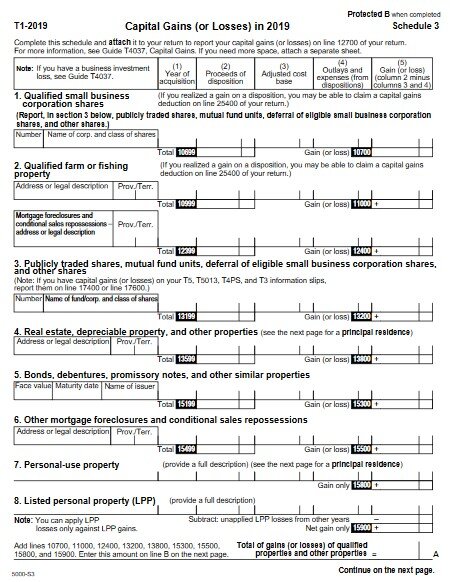

Kim thanks for being with us. 13 hours agoOn August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released draft legislation and make certain technical changes Proposal. Capital gains x 50 Inclusion rate x Your personal tax rate Capital gains owed.

The basic exemption amount remains at. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues. The government would like to see the tax rate on both capital gains and dividend income be the same.

Its taxed at your marginal tax rate just like any other income. The maximum pensionable earnings is 64900 an increase of 3300 from the 61600 in 2021. As a result tax advisors derive plans to ensure their clients realize capital gain income instead of dividends.

The tax-free principal residence exemption has helped plenty of Canadians earn tax-free. Recently there have been a number of calls to change the way capital gains income is taxed in Canada. The draft legislation includes measures first announced in the 2022 Federal Budget with updated versions of draft.

This is the income inclusion. Historically Canadian income tax law has by design allowed for preferential tax treatment of Eligible Capital Property. Its important to keep some things in mind here to avoid surprises on your tax bill.

The basic formula for calculating capital gains is the following. Lifetime capital gains exemption limit. When it comes to capital gains tax in the provinces capital gains is calculated the exact same way as it is federally with 50 of the capital gain being taxed according to your marginal tax rate.

Remember the deadline is the 18th this year not the 15th because the 18th is a Monday. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. Potential tax changes due to COVID-19 Capital gains tax.

The news release that accompanied the Proposals invites. The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer rate. NDPs proto-platform calls for levying.

Lets talk more about this with Kim Dula CPA and managing partner at Friedman LLP. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022. Long-term capital gains are capital assets held for more than a year.

This depends on your personal tax rate which is based on your personal marginal tax rate for the province you live in which. The Proposals include amendments to both the Income Tax Act ITA and the Excise Tax Act ETA. For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218.

It was then increased to 6667 per cent in 1988 and then to a high of 75 per. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the 2021 Federal Budget. For more information see What is the capital gains deduction limit.

Depending on how long you hold your capital asset determines the amount of tax you will pay. Expected under Liberal government. Proponents argue that higher taxes on capital gains will reverse rising income and wealth inequality and raise substantial tax.

For the past 20 years capital gains in Canada have been 50 taxable. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Guidance on affidavits and valuations Bill C-208.

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Understanding Taxes And Your Investments

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Tax Calculator For Relative Value Investing

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Canada Capital Gains Tax Calculator 2022

Capital Gains Tax Calculator For Relative Value Investing

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes